Have Questions on Real Estate Investing? Find Do not Make investments Your Hard-Earned Money Without Reading These tips!

In case you thought you had been going to only make the decision to be a real property investor without a lot knowledge, then you are better off forgetting the venture. However, if you are enthusiastic about doing it and educating yourself about making smart decisions in the case of actual property investing, then you're ready to maneuver in the fitting path. Let this article show you how to build up your data base.

Always be on time if you arrange a meeting with a possible client. This may point out that you simply imply business and will present no disrespect to your potential customer. Coming to a gathering late shows that you are unorganized and do not care about your customers, which will trigger you to lose them.

Make sure you select areas that have a buzz round them, especially if you'll be able to tell that early on. Anyone Can Grow to be Knowledgeable About Investing With These Easy Ideas improve the potential resale value of your preliminary funding. It is also a good idea to look for properties that won't want quite a bit maintenance.

When the time to negotiate occurs, it's worthwhile to keep in mind that silence is golden as you need to hear every little thing the opposite party says. By dominating the negotiations with your own talking, you might miss out on an incredible alternative. If you hear carefully, you usually tend to get a superb deal.

When assessing actual property for investment, be sure to choose properties that will pay you a fair money value on return. Do not forget that buying a property reduces your liquid belongings briefly. You want to make certain to be able to replenish them shortly and amply. Do not forget that your money was incomes between four and 6 p.c curiosity in the financial institution. While you make investments it, it is best to search a better return.

For those who turn out to be a seasoned actual estate investor, there are particular to be ups and downs. Don't be discouraged by the unhealthy instances you could encounter. You will come out on prime in the event you persevere. Always remember to maintain educating yourself on real estate investing, and soon enough success will certainly observe.

Understand that real estate investing is a commitment. You may have heard lots about flipping properties shortly for profit, however the fact is you are more likely to make good earnings by purchasing carefully and managing the property wisely till property values improve. Buy Confused About Investing? The following pointers Can assist! that may appeal to strong tenants for regular, ongoing income.

Be prepared to make sacrifices. Profit in actual property does not happen overnight. You may must surrender some free time to be successful in actual estate investing. There's always time for leisurely actions once the work is completed.

Avoid properties which have prices which can be too excessive or low. Should you make investments too much to start with, you're unlikely to make a great revenue. An affordable one will likely require a serious investment of time and money to convey it up to par. The most effective plan is to purchase high quality properties at moderate prices, so don't look for either the fancy or the run down.

Be very broad in your estimates of expenses and income. Estimate excessive in relation to repairs, bills and improvements. Estimate low relating to income. When you do that, you will keep away from disappointment. Moreover, you can be more more likely to manage your money effectively and find yourself with more of it in your pocket.

Getting an education on real estate investment goes to be costly in a method or one other. You want to speculate your time by studying about the ins and outs of the business. Orl it is perhaps from future errors. Do what you possibly can to achieve data from the individuals you realize.

Just remember to handle your tenants, and they do not wind up managing you. If doable, use a landlord or property management company as a buffer between you and tenants. Any potential tenants that ask for lower rent charges or can't come up with a safety deposit and the first month rent are usually not always going to pay on time.

Convey a contractor with you if you check out a possible funding property. A contractor can give you an thought of any necessary repairs, as well as the price to do these repairs. This may assist you to to resolve on what kind of provide to make, do you have to resolve to purchase.

If you're renovating a property and you want to sell it, attempt to make it appealing to a wide quantity of people. People that need to purchase will want to make use of it as their residence, and your personal tastes may not match theirs. Keep it clean and simple to allow them to imagine their very own type in the space.

Know when it is time to chop your losses. Though you may want all of your investments to pan out, this is just not a realistic standpoint. Have a strategy and a plan for understanding when it is best to dump investments that aren't worthwhile for you. You will save cash in the long term.

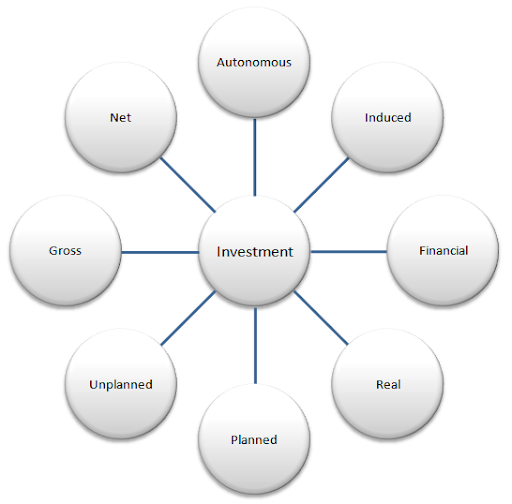

Determine your anticipated earnings and how you will receive them. Work out what kind your earnings will probably be in. There are some ways to get them back. These include rent, dividends, and interest. Some sorts like real estate and stocks can earn and develop in value. Work out what the potential of your investment is over time.

Keep your feelings below management. There will always be cycles in a market. You might get excited whenever you see that the market is on the rise. When What Each Real Property Investor Ought to Know goes back down, you could really feel nervous and scared. Giving in to those feelings can lead to poor choices at the most inopportune occasions.

Suppose about every part you've realized. You in all probability are excited and ready to move on to learn much more about your new funding choice. Investing in actual property is very popular and can enable you to construct up substantial wealth. Have all the pieces in line before you get started, and remember to assume each decision by way of as you build up your portfolio.